bir psic code list|Bureau of Internal Revenue : iloilo Group Code; Growing of non-perennial crops. This group includes the growing . The Office of the City Assessor (OCAs) is responsible for carrying out real property tax-related functions such as locating all taxable real properties (land, buildings, and other structures, and machinery) in the city, identifying and updating ownership, establishing taxable values based on actual use, and applying legal exemptions for .

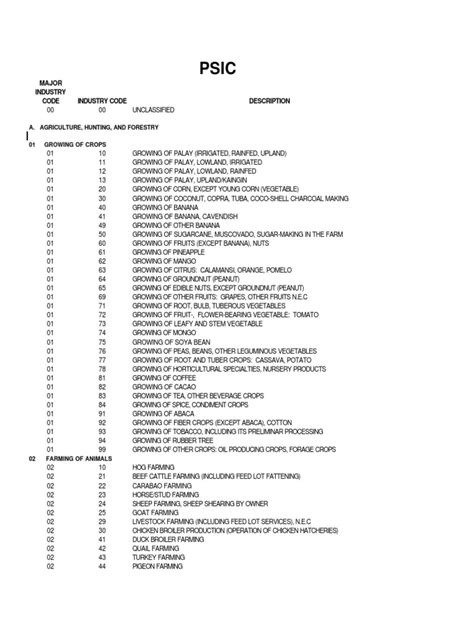

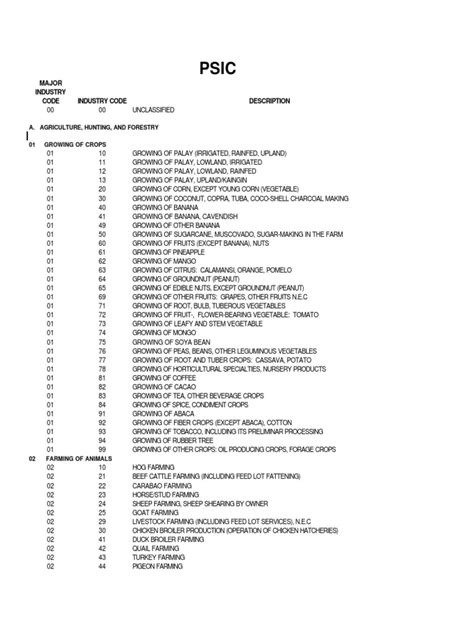

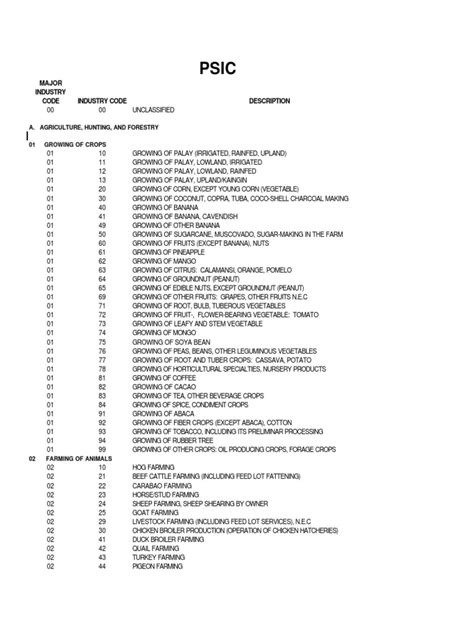

bir psic code list,The PSIC is a detailed classification of industries in the Philippines based on productive activities. It has 1,360 sub-classes with 5-digit codes and is updated in 2019.Group Code; Growing of non-perennial crops. This group includes the growing .bir psic code list Bureau of Internal RevenuePSIC Classes. Show entries. Search: Class Description. Class Code. Growing of .Philippine Standard Geographic Code (PSGC) 2019 Updates to the 2009 .

Philippine Standard Geographic Code (PSGC) 2019 Updates to the 2009 .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a .

Pursuant to Republic Act 10625, also known as the Philippine Statistical Act of 2013, .Additionally, the NIR assumes the region code "18," which was previously .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the .PSIC Classes is a statistical classification system for industries in the Philippines. It consists of 524 classes with codes and descriptions, such as growing of cereals, leguminous crops and oil .2009 PSIC is the latest version released by the NSCB after the 1994 PSIC was amended in 2002. The PSIC serves as a guide in the classification of establishments according to their economic .BIR Form No. 1701 shall be filed by individuals who are engaged in trade/business or the practice of profession including those with mixed income (i.e.., those engaged in the trade/business or profession who are also earning .PSIC is a detailed classification of industries in the Philippines based on productive activities. It has 5 levels of categories from sections to sub-classes, each with a corresponding code.

The Philippine Standard Geographic Code (PSGC) is a classification and coding of the geographical-political subdivisions of the country, such as the region, the province, the .

HOW IS THE BENCHMARKING PROCESS IMPLEMENTED? Benchmarking starts with the gathering of the taxpayers’ VAT returns, income tax return, and financial .2019 Updates to the 2009 PSIC-Apr082022 - Free ebook download as PDF File (.pdf), Text File (.txt) or read book online for free.

GROUP CLASS SUB- INDUSTRY DESCRIPTION PSIC PSIC ISIC CLASS 1994 1977 3.1 01781 Growing of orchids 01781 11952 0112 01782 Growing of flowers or flower buds (except .Philippine Standard Geographic Code (PSGC) 2019 Updates to the 2009 Philippine Standard Industrial Classification (PSIC) 2012 Philippine Standard Occupational Classification (PSOC) 2018 Philippine Standard Classification of Crime for Statistical Purposes (PSCCS)Subclass Code; Growing of leguminous crops such as: mongo, string beans (sitao), pigeon peas, gisantes, garbanzos, bountiful beans (habichuelas), peas (sitsaro) 01111: Growing of groundnuts. 01112: Growing of oil seeds (except groundnuts) such as soya beans, sunflower and growing of other oil seeds, n.e.c. 01113: Growing of sorghum, wheat. 01114The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .

Philippine Standard Geographic Code (PSGC) 2019 Updates to the 2009 Philippine Standard Industrial Classification (PSIC) 2012 Philippine Standard Occupational Classification (PSOC) 2018 Philippine Standard Classification of Crime for Statistical Purposes (PSCCS) main before footer.The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .bir psic code list Benchmarking starts with the gathering of the taxpayers’ VAT returns, income tax return, and financial statements. The tax returns are sorted according to the specific industries or based on the Philippine Standard Industry Code (PSIC). PSIC is commonly used to identify and classify the specific business categories in business.The 2009 PSIC provides a Summary of Classification Scheme which presents a list of sections, divisions, and their corresponding number of groups, classes and sub-classes, and a Detailed Classification presenting the hierarchy of categories of industries such as: 21 sections (one-digit alphabetic codes) 88 divisions (2-digit codes)

GROUP CLASS SUB- INDUSTRY DESCRIPTION PSIC PSIC ISIC CLASS 1994 1977 3.1 SECTION A. AGRICULTURE, HUNTING AND FORESTRY DIVISION 01. Growing of crops This division includes growing of temporary and permanent crops: growing of cereal grains such as rice, wheat, corn and grain sorghum, etc.; growing of sugar

Item 14 PSIC Code: Philippine Standard Industrial Classification Code (PSIC): Refer to www.bir.gov.ph for your applicable PSIC or visit the local BIR Office. Item 15 Method of Deduction: Choose either Itemized Deduction under Section 34(A-J), NIRC, as amended, or Optional Standard Deduction (OSD) which is 40% of Gross Income under Section 34(L .Bureau of Internal RevenueItem 14 PSIC Code: Philippine Standard Industrial Classification Code (PSIC): Refer to www.bir.gov.ph for your applicable PSIC or visit the local BIR Office. Item 15 Method of Deduction: Choose either Itemized Deduction under Section 34(A-J), NIRC, as amended, or Optional Standard Deduction (OSD) which is 40% of Gross Income under Section 34(L .The coding scheme of the 2012 PSOC has four-digit code with one-digit code representing the major group, two-digit code for the sub-major group, . (PSIC) 2012 Philippine Standard Occupational Classification (PSOC) 2018 Philippine Standard Classification of Crime for Statistical Purposes (PSCCS) main before footer.

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR Forms, .Philippine Standard Industrial Classification - Free ebook download as PDF File (.pdf), Text File (.txt) or read book online for free. The document describes various agricultural industries in the Philippines classified by their PSIC and ISIC codes. It discusses the growing of crops such as cereals, rice, corn, sugarcane, tobacco, vegetables, fruits, flowers, and other plants.

Item 14 PSIC Code: Philippine Standard Industrial Classification Code (PSIC): Refer to www.bir.gov.ph for your applicable PSIC or visit the local BIR Office. Item 15 Method of Deduction: Choose either Itemized Deduction under Section 34(A-J), NIRC, as amended, or Optional Standard Deduction (OSD) which is 40% of Gross Income under Section 34(L .BIR Form No. 1601-E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) . Any person required under the National Internal Revenue Code or by rules and regulations promulgated thereunder to pay any tax, make a return, keep any record, or supply correct and accurate information, who willfully fails to pay such tax, make . It’s the BIR Form 1901 for self-employed, BIR Form 1903 for corporate taxpayers, or BIR Form 1904 for one-time taxpayers and people registered under EO 98. If you’re an employee, you may request a copy of your BIR Form 1902 from the HR department of the employer that handled your TIN registration.NATIONAL INTERNAL REVENUE CODE OF 1997 As amended by Republic Act (RA) No. 10963 (TRAIN), RA 11256, RA 11346, RA 11467 and RA 11534 (CREATE) TITLE I. ORGANIZATION AND FUNCTION OF THE BUREAU OF INTERNAL REVENUE (As Last Amended by RA 10963) SEC. 1. Title of the Code. - This Code shall be known as the National Internal Revenue Code .

bir psic code list|Bureau of Internal Revenue

PH0 · Return of the BIR benchmarking program

PH1 · Philippine Standard Industrial Classification

PH2 · PSIC Classes

PH3 · PSIC

PH4 · Classification Systems

PH5 · Bureau of Internal Revenue

PH6 · 2019 Updates To The 2009 PSIC

PH7 · 2009 Philippine Standard Industrial Classification

PH8 · 1994 Philippine Standard Industrial Classification

PH9 · 1701 Guidelines and Instructions